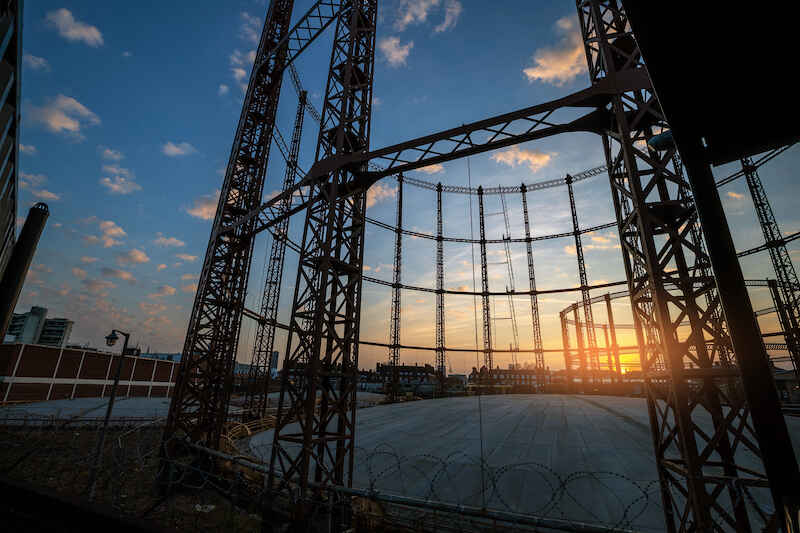

Energy Suppliers Say the Price Cap is Driving Them out of Business

Energy suppliers contend that the price cap shielding customers from surging natural gas prices is “not fit for purpose,” and will topple companies, with households facing the bill for these failures.

Wholesale natural gas prices have soared 900% since January, leaving manufacturers threatening production halts and energy suppliers struggling to keep their heads above water. Nine retail gas and electricity suppliers went to the wall in September, impacting 1.7 million households.

A price cap in place since 2019 limits what suppliers can charge households on their standard variable tariffs. The cap is adjusted biannually, accounting for wholesale price fluctuations, and rose by £139 on 1 October.

Despite this 12% hike, suppliers argue that the cap hasn’t kept pace with spiralling wholesale prices. According to calculations from financial services firm Investec, the cap is currently set £550 below the annual cost of procuring energy for a household.

Three weeks ago, Dale Vince, founder of Ecotricity, put the gap between the price cap and market price was “£400 per customer.” Gas prices have since surged higher.

Vince said the government is “killing companies” by preserving the cap on retail prices but not similarly limiting wholesale prices. He told BBC Radio 4: “It’s illogical to hold prices at one end of the supply chain and not the other end, and the natural consequence is companies going out of business.”

Paul Richards, chief executive of Together Energy, voiced similar concerns, telling the BBC his company is currently making losses. He supports a price cap to protect customers, but the current mechanism is “not fit for industry, nor is it fit for customers.”

The cost of supplying customers is so high, Omni Energy recently got into trouble by trying to offload its heaviest users to avoid insolvency. The company reportedly switched loss-making customers to rivals Bulb and Scottish Power without their consent, before being stopped by Ofgem.

Omni says it could be the 13th energy supplier to fold this year, and others are likely to follow. And these failures will come at a “huge cost” for consumers, suppliers warn.

When energy suppliers fold, they leave debts to Britain’s green energy schemes, the Renewable Obligation (RO) fund and the Feed-in Tariff (FiT) scheme, which are typically mutualised across all suppliers.

Additionally, when surviving companies accept stranded customers and cover their credit balances, they incur costs they can later recoup from the market, pushing up bills for everyone. Investec estimates that the rescue of 1.5 million customers deserted by seven suppliers between August and late September comes with a bill of £826 million—the equivalent of £30 per household.

Critics say the crisis is merely cleaning shop, felling only badly-run energy suppliers that weren’t properly hedged against market volatility. But regardless of whether these failed companies were judiciously run out not, their collapse leaves a financial blackout that consumers will have to fill.f

Read on our blog

With the government poised to implement tough new measures to...

Budget broadband provider TalkTalk has been notifying customers via email...

A year-long investigation by charity Citizens Advice has revealed a...

Education Secretary Nadhim Zahawi has announced a new commitment to...